Al Iqtishad is a peer-reviewed journal published by the Faculty of Sharia and Law, UIN Syarif Hidayatullah Jakarta in cooperation with The Indonesian Association of Islamic Economists. This journal focused on law and practice of sharia economics. The journal is published twice a year on January and July. The aim of the journal is to disseminate the Islamic law on economics and finance researches done by researchers both from Indonesian and overseas

Al Iqtishad welcomes scholarly works on Islamic economic theory and practice, particularly those engaging with Sharia-based legal, ethical, and policy frameworks. The journal encourages legal-economic analyses, comparative Sharia financial regulations, and discourses on the governance of Islamic economic institutions.

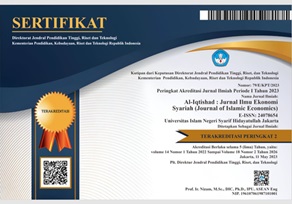

Al Iqtishad has been accredited as a scientific journal by the Ministry of Research-Technology and Higher Education Republic of Indonesia: 79/E/KPT/2023 PERIOD: 2022-2026

AL-IQTISHAD: JURNAL ILMU EKONOMI SYARIAH

ISSN 2087-135X (Print) | ISSN 2407- 8654 (Online)

CALL FOR PAPERS

Volume 17 No. 1 , January-June 2025

Al Iqtishad Journal in collaboration with the Faculty of Sharia and Law, and the Faculty of Economics and Business will organize an International Conference on "Promoting Inclusive and Resilent Regulatory Frameworks and Policies for Sustainable Islamic Economy and Finance in the Wolrd".